Acquisition project | Rental Agreement

What is the NoBroker Rental Agreement product?

NoBroker's rental agreement service is designed to streamline the process of creating and registering rental agreements in India. This service aims to eliminate the traditional hassles associated with rental agreements by offering a convenient, efficient, and legally compliant solution. NoBroker's rental agreement service simplifies creating and registering rental agreements by offering a comprehensive, user-friendly, and legally compliant solution. It addresses common pain points such as multiple office visits, complex legal requirements, and time-consuming processes, making it an attractive option for both landlords and tenants. We are currently operating in 150 cities in India and serve NRI landlords as well all over the world.

What does the current market look like and what are the major shortcomings and challenges in the market for us?

The main challenges are;

- Limited Awareness: Many potential customers in the unorganized sector are unaware of online rental agreement services and their benefits.

- Free Online Draft: Multiple companies like ClearTax and Magic Bricks provide free drafts for agreements and anyone can easily download and print them.

- Brokers: In multiple cases, the broker gets the agreement done after fulfilling the tenancy needs and gets a cut directly from the brokerage.

- Competitors mislead the customers as they will provide agreement in just 5 minutes.

Main shortcomings and how we are solving them;

- Notary charges: In the unorganized sector local shops charge random prices for notarization (The role of a notary public is to serve as an impartial witness to the signing of important documents, helping to deter fraud and ensure the integrity of the process) For multiple government processes a notary agreement is a valid document.

- Registered Rental Agreement: In Maharastra, RRA is made for which biometric verification is a necessary step for both tenant and landlord. We provide biometric verification service at the doorstep of the customer, which is a very big hassle in the current market.

- NRIs: For landlords who stay outside India getting the biometric verification done is again a huge pain, we send biometric devices outside India to solve their purpose and assist them online. Very few companies are providing this service, Anulom is our big competitor in this segment.

What is the core value proposition ??

- End-to-End Service: NoBroker handles the entire process from drafting the agreement to getting it registered, saving users the hassle of multiple visits to legal offices.

- Transparent Pricing: NoBroker offers competitive and transparent pricing with no hidden charges, making the service affordable.

- Automated reminders: Reminders for agreement renewals.

- Biometric verification at home

ICP and JTBD (meet the users)

Questions | Binnya | Nihit (NRI) | Piyush (GM of coliving space) | Vtsal | Atriya | Vishakha |

|---|---|---|---|---|---|---|

Gender | Female | Male | Male | Male | Female | Female |

Age | 22 | 38 | 28 | 45 | 48 | 32 |

Owner/Tenant | tenant | owner | owner | owner | owner | tenant |

Type of house | PG | Apartment | multiple rooms in a standalone building | apartment | apartment | apartment |

Salary Bracket (per month) | 30K | above 5 lakh | 80k | above 1.5 lakh | not-working | above 2 lakh |

Number of owned houses? | - | 3 | 30 rooms in 1 building | 1 | 1 | - |

City the person lives in? | Bangalore | Amsterdam | Bangalore | Hyderabad | Faridabad | Bangalore |

City the person has the property in? | - | 2 Mumbai and 1 Bangalore | Bangalore | Hyderabad | Gurgaon | - |

If tenant-how did they find the house? || If owner- how did they find the tenant? | PG where her office colleagues live in | From NoBroker | own marketing platform | from a broker | NoBroker | Flat and flatmates Facebook |

Preferred Platforms? | Facebook, friends referrals | Nobroker and Housing | Facebook leads | broker network | NoBroker | NoBroker, Housing |

Did they make an agreement? | No, the owner did tenant verification | Yes | Yes | Yes | Yes | No |

Who makes the agreement Owner/Tenant? | - | Owner | Owner | Owner | Owner | Owner |

Who paid for the agreement? | - | Owner | Charged from Tenant | Charged from Tenant | Charged from Tenant | Half amount charged from Tenant |

Where did they make the agreement? | - | Nobroker | From a local vendor (bulk rate) | Broker did it | NoBroker | do not know |

What discussions generally affect the agreement clauses? | painting and cleaning charge | painting and cleaning charge | painting and cleaning charge | painting and cleaning charge | painting and cleaning charge | Deposit and painting and cleaning charge |

On which app do they spend there most of the time? | Reddit, Outlook | WhatsAppFacebook, Facebooka , Instagram | whatsapp, gmail, Instagram, news apps | whatsapp, facebook, Instagram | Gmail, WhatsApp, Instagram, LinkedIn | |

Changed job recently | yes | no | no | no | no | yes |

Did they book any other service from NoBroker after the tenant/house hunt? | - | yes for AC servicing, used Urban CompanyNo broker for cleaning | used Urban CompanyCompany for cleaning, NoBroker for tenant verification | used Urban company for cleaning | only tenant finding, used Urban company for cleaning | no, used Urban Company for salon and cleaning service |

Did they use the NB app before? | - | for multiple services | yes for finding tenants | yes for finding tenants | yes for finding tenants | for house hunting |

Is there agreement a renewal agreement or a first-time one? | - | renewal | first time | first time | first time | first time |

ICP Prioritisation

ICP's | Adoption Curve | Frequency of Use Case | Appetite to Pay | TAM | Distribution Potential |

|---|---|---|---|---|---|

ICP-1 Binnya (tenant, working professional, low salary base, female) | Medium | Low | Low | Low | Low |

ICP-2 Nihit (owner, NRI, working professional, salary base high, male) | High | High | High | Low | High |

ICP-3 Piyush (GM of coliving space, working professional, salary base high, male) | High | High | High | High | High |

ICP-4 Vatsal (owner, working professional, salary base high, male) | High | High | High | High | High |

ICP-5 Atriya (owner, homemaker, female) | Medium | High | Low | Low | Medium |

ICP-6 Vishakha (tenant, working professional, salary base good, female) | High | Medium | High | High | High |

- Based on the above framework, we will narrow it down to 3 ICPs:

ICP 2 (35-55, Working professional, NRI, own a house in India), ICP3 (21-40, Working professional, working in a coliving space which has multiple rooms, one tie-up will allow us to create various agreements ), ICP4(35-55, Working professional, own a house/any rental space)

JTBD in the early scaling stage;

| Goal |

|---|---|

Functional |

|

Personal |

|

Financial |

|

Social |

|

TAM & SAM calculation-

To find the top ceiling of the market we are taking the total Indian population as of 2023 and drilling it down based on the demand for taxpayers who surely make Rent Agreements for HRA in tax filing (assuming people don't make rent agreements in tier-3 cities before moving into the rental house, they make it only for tax filing). Online adoption will be 70% in urban taxpayers and 10% in rural taxpayers.

Annual Basis (assuming user need on an average 1 agreement in a year)

Total Population of India (2023) | 141 Crore |

Tax Payers (6%) | 8.2 Crore |

TAM (500*8.2) | Rs. 4100 Crore |

A) Urban taxpayers (35%) | 2.87 Crore |

B) non-urban taxpayers (65%) | 5.33 Crore |

a) people who make agreements from offline channels in urban (40%) | 1.14 Crore |

b) people who make agreements from offline channels in non-urban (90%) | 4.8 Crore |

c) people use brokers in urban for agreements (30%) | 0.86 Crore |

d) people use brokers in non-urban for agreements (5%) | 0.26 Crore |

people who will make agreement using an online channel ( A+B-a-b-c-d) (since brokers are not allowed on our platform) | 1.14 Crore |

Average revenue per user(as per NoBroker ) | Rs 500 |

SAM (500*1.14) | Rs. 570 Crore |

SOM calculation

The SAM includes the chances of people buying agreements from other online websites.

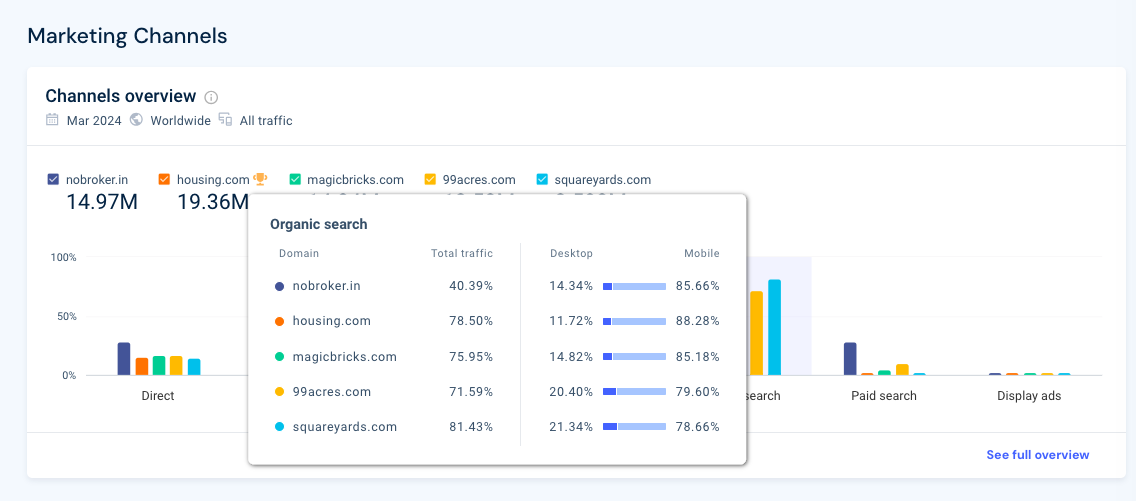

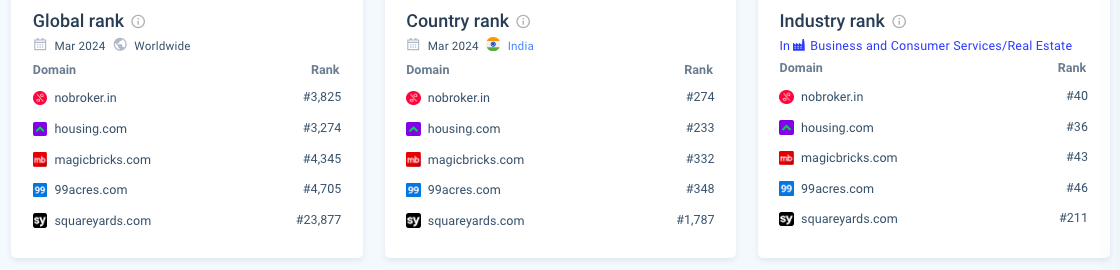

Now based on the search results on SimilarWeb for traffic share, assuming 16% market can be captured by NoBroker against the competitors.

Top Companies | Market Share | Market (Rs. Crore) |

|---|---|---|

NoBroker | 16% | 91.2 |

Housing | 13% | 74.1 |

MagicBrick | 15% | 85.5 |

legaldesk | 23% | 131.1 |

Esahayak | 9% | 51.3 |

legaldoc | 2% | 11.4 |

drafter | 1% | 5.7 |

rest | 21% | 119.7 |

TAM- Rs 4100 Crore, SAM- Rs 570 Crore, SOM- Rs 91.2 Crore

NoBroker's current annual revenue for Rental Agreement is more than 12 crore (can't quote the actual figure) while the presence is in 150 cities of India and still expanding in other cities.

Channel Analysis

A quick search on SimilarWeb shared interesting insights on Organic and Paid searches for the NoBroker Rent agreement.

Organic Search Analysis Vs Paid Search

NoBroker is leading in Paid Search but in organic search Housing.com tops the chart. This overview is for the NoBroker website as a whole but to check for the Rental Agreement segment I have done a keyword analysis.

Keyword analysis-

As per SimilarWeb I found the top 5 keywords in my business segment and analyzed them based on their search volume, the top keyword is "Rent Agreement Online".

Based on the top keyword NoBroker tops the chart in both the Organic and Paid search when compared to top competitors Housing.com, Magicbricks.com, edrafter.in, and rental agreement.in.

And in Maharashtra, It is Anulom and maharashtra.gov.in

In a nutshell

Organic and Paid analysis

- SERP also shows that "Free Rent Agreement" is positioned on rank 2 as I mentioned earlier these competitors are claiming that they will provide free agreement is a big problem.

- Organic as well as Paid both are good for NoBroker in tier-1 cities like Bangalore, Mumbai, Pune, Chennai, and Hyderabad but for tier 2 and tier 3, it is not great and local competitors are winning lines.

Product Integrations

Our revenue peak arises during Dec & Jan (ICPs have to submit Rental Agreements in their respective companies for HRA in IT Declaration), June &July (before ITR filing) so they will search for Tax and HRA calculators. Daily they also interact on the facility management apps (NBHood, MyGate) of their societies. Plus I would go for On-site marketing which includes cross-selling and up selling of our product.

Referral

This has been not utilized as a distribution channel. Significantly, it's not utilised by all competitors. This could potentially be because of higher conversion time and lower frequency, one-time use case in a year.

Content loops

This will not work that well for Rent Agreement product.

Channel Prioritisation Framework

Channel Name | Cost | Flexibility | Effort | Lead Time | Scale |

|---|---|---|---|---|---|

Organic | Low | High | Low | Low | High |

Content Loops | Medium | Medium | Medium | Low | Low |

Referrals | Low | Medium | Medium | High | Low |

Paid ads | High | Medium | Medium | Medium | Medium |

Product Integrations | High | Low | Medium | Medium | High |

Based on the above analysis and scope of improvement moving ahead with Organic Search and Product Integration and On-Site Marketing.

- Organic Search

As our product is in the stage of early scaling for Tier-2&3 cities so I will follow the potential keyword list city-wise and start SEO optimization. I would focus on optimizing keywords looking at the search volume, search result to click rate, and potential sign-ups. I

In tier-1 cities where we have already tried out SEO as a strategy, I would go for On-Site Marketing, Upselling,sign-ups, and Cross-Selling the product on different products of NoBroker.

For eg- Users who have finalized houses would very likely make an agreement post that. Will club it with the basic tenant subscription plan like already doing for the landlord plan.

- Product Integration

Our revenue peak arises during Dec & Jan (ICPs have to submit Rental Agreements in their respective companies for HRA in IT Declaration), June &July (before ITR filing) so they will search for Tax and HRA calculators. Daily they also interact on the facility management apps of their societies.

| | ||

|---|---|---|---|

ICP | Working Professionals | 21-60 | Tier-1 | ||

Which product do they interact with? | HRA Calculator (Groww/ClearTax) | MyGate/NoBrokerhood | |

How frequently do they interact with? | Low | High | |

How important are those interactions? | Important | somewhat | |

Can my product add value to those interactions? | Yes | Maybe | |

How many new use cases/ customers can I get? | High | High |

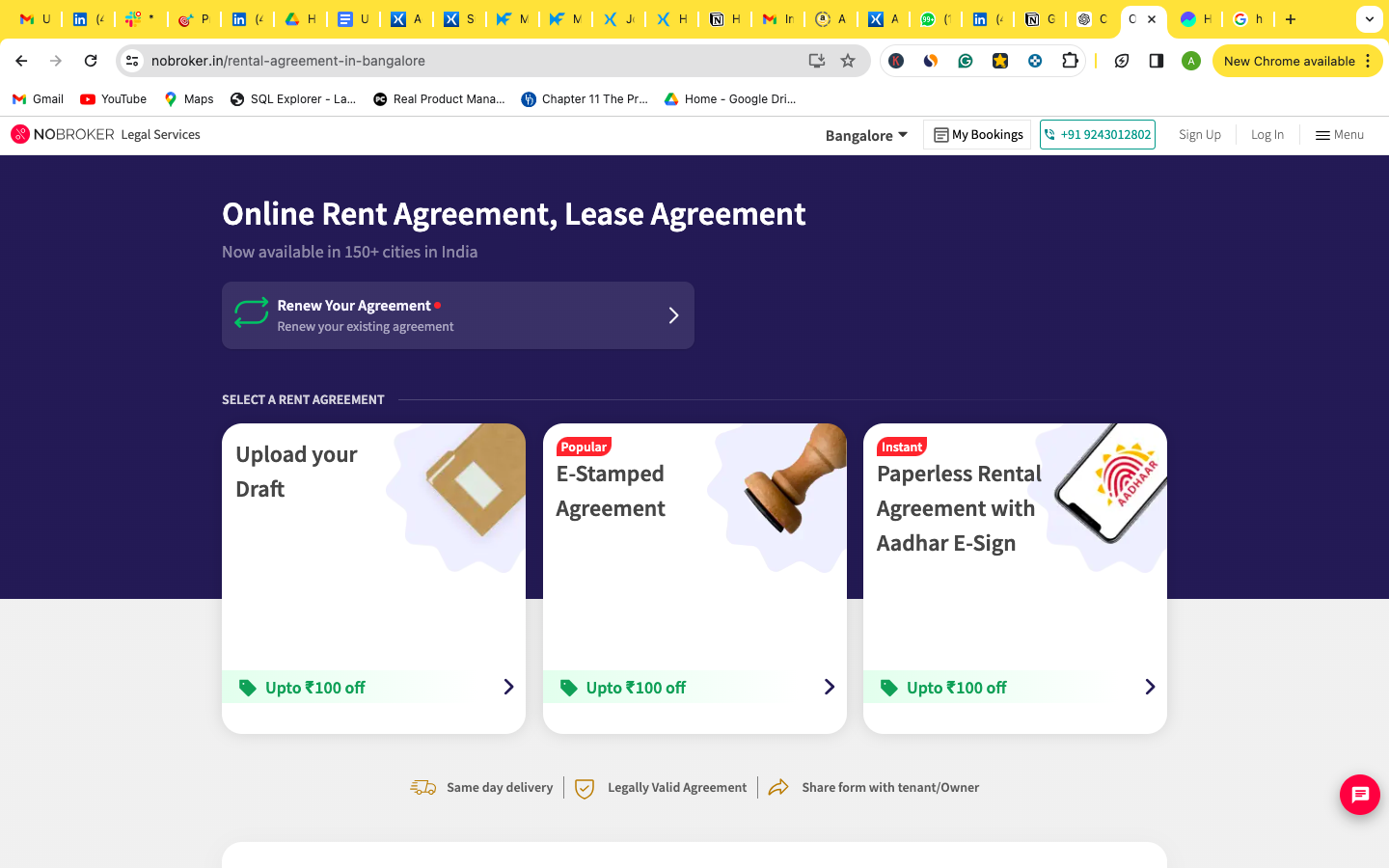

- User flow on Groww/ClearTax would be

User searches on Google for HRA calculator-

The top 2 links would be of Cleartax and Groww

The user either clicks on Groww or Cleartax to calculate HRA, post this in the Groww/ Cleartax page we will show our agreement link-

Clicking on this link will directly take the user to our Rental agreement page-

2.User flow through NoBrokerHood, the user opens the app to explore different facilities and to approve and reject entries, there I will add the "Rental Agreement" service icon, clicking on which will take them to the Rental agreement page.

Thanks for Reading !!

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.